igrat-sloty-online.ru Learn

Learn

Fixed Price Cars

Buy at different Exleasingcar auctions- closed, open, fixed price, damaged and commercial vehicles. FPVS Vehicles are only available to customers signed up in the Federal Surplus Property program. Vehicle auctions are attended all year round where we look for. Need a car today? Choose fixed price! When you buy a car at a fixed price, you get a car that has been tested and documented to be in good condition. We're one of the fastest-growing used car dealerships in Utah. Our unique approaches help all our customers buy with confidence. Create your own menu of fixed-price jobs using our automotive repair labor guide. It makes it easy to set up a schedule for customers' quick approval. We operate a fixed price policy that ensures our cars are the lowest they can be, we aim to take the hard work and stress out of buying your next car. Request and acquire federally-owned vehicles through the Fixed Price Vehicles Sales Program. Payment is required prior to obtaining the vehicle. Buying · Online access to daily-live bid auto auction and fixed price Buy Now evening sale · Make offers or ask questions on eligible vehicles you are interested. With the AutoNation 1Price, you never have to participate in another used car price negotiation again. Our set and fixed prices eliminate the mystery from car. Buy at different Exleasingcar auctions- closed, open, fixed price, damaged and commercial vehicles. FPVS Vehicles are only available to customers signed up in the Federal Surplus Property program. Vehicle auctions are attended all year round where we look for. Need a car today? Choose fixed price! When you buy a car at a fixed price, you get a car that has been tested and documented to be in good condition. We're one of the fastest-growing used car dealerships in Utah. Our unique approaches help all our customers buy with confidence. Create your own menu of fixed-price jobs using our automotive repair labor guide. It makes it easy to set up a schedule for customers' quick approval. We operate a fixed price policy that ensures our cars are the lowest they can be, we aim to take the hard work and stress out of buying your next car. Request and acquire federally-owned vehicles through the Fixed Price Vehicles Sales Program. Payment is required prior to obtaining the vehicle. Buying · Online access to daily-live bid auto auction and fixed price Buy Now evening sale · Make offers or ask questions on eligible vehicles you are interested. With the AutoNation 1Price, you never have to participate in another used car price negotiation again. Our set and fixed prices eliminate the mystery from car.

5 tips for negotiating a car price · 1. Research the numbers · 2. Get preapproved financing · 3. Shop around for car loans · 4. Focus on the “out-the-door” price · 5. Multiple car brands including Mercedes Benz, Honda, and Subaru, have announced that they are introducing a new car pricing model, fixed pricing, across their. With the AutoNation Price, you never have to participate in another used car price negotiation again. Our set and fixed prices eliminate the mystery from car. But when it comes to wanting to sell or buy cars, a fixed price policy ensures that the process is fair for both buyers and sellers, as a vehicle will always. Fixed price means you can sell more vehicles, get more market share, and make money on the cars later instead of upfront. Upvote 2. Downvote. Our set and fixed prices eliminate the mystery from car prices. All of our pre-owned cars reflect market value and many come with additional cost savings and. FIXED PRICES. Finally, some auction platforms (eCarstrade included) will also offer cars for Fixed prices. This means a set price will be given to the car. Our set and fixed prices eliminate the mystery from car prices. All of our pre-owned cars reflect market value and many come with additional cost savings and. Multiple car brands including Mercedes Benz, Honda, and Subaru, have announced that they are introducing a new car pricing model, fixed pricing, across their. 5 tips for negotiating a car price · 1. Research the numbers · 2. Get preapproved financing · 3. Shop around for car loans · 4. Focus on the “out-the-door” price · 5. Often the dealer is anxious to reduce dated inventory and the buyer is excited about the prospect of buying a popular model at a reduced price. Manheim's BuyNow listings give you the chance to make an enquiry on a vehicle or piece of equipment for immediate sale, outside of our auction schedule. In some cases, licenced dealers may also be able to click on a BuyNow button to secure a vehicle at a fixed price. Click here for BUYNOW listings. Stay. We operate a fixed price policy that ensures our cars are the lowest they can be, we aim to take the hard work and stress out of buying your next car. Usually, no. (sometimes prices drop, but this is very rare.) If a fixed price car doesn't sell, the vendor might run the car through the auction. If the top bid. With the AutoNation Price, you never have to participate in another used car price negotiation again. Our set and fixed prices eliminate the mystery from car. Fixed Price. Next. Kentico UCM Display. Products. Cars · Motorcycles · Salvage Cars · Trucks · Earthmoving & Mobile Plant · Agricultural · Trailers · Boats &. Car Fixed price in Belgium - · BMW X3 - · KIA XCEED · NISSAN NV · MERCEDES-BENZ C-Klasse · End: 29 rugp. 15h A selection of government car auctions fixed price which we have listed for sale at Grays. Here you will find hundreds of used cars to buy from different car brands – at auction and for a fixed price. Many are in the best condition.

Md Live Poker Promotions

In addition to cash games, the poker room regularly holds daily tournaments and is also home to a number of tournament festivals, including the Maryland. Poker · Tournaments · September High Hand Giveaway · Bad Beat Jackpot · Big Stax · Game Types · Live Game Report · Hotel · Contact Poker Room. Sign up for Live! Rewards® and earn up to $50 in Free Slot Play, Direct Bets or Comps. Plus, everyone gets a free Tote Bag! The casino also offers Giant Jackpots, the first slots jackpot of its kind in the State of Maryland. This mystery slot progressive jackpot is guaranteed to hit. Discover a wide range of real money poker tournaments at BetMGM. From daily Maryland Sportsbook Promos Massachusetts Sportsbook Promos Michigan. promotions and tournaments. My strategic insights help maximize revenue and enhance customer satisfaction, ensuring that our poker room remains a leader in. Maryland Live! poker tournament schedule and information, including starting times, buy-ins, prize pool guarantees, and freerolls. $10, Live Poker Giveaway. 1PM-5PM. Earn entries from August September 21 for live poker time played (Cash for Hours) and qualifying weekly high hands. Upcoming Promotions ; $ Daily High Hands. Dates & Times May Vary ; $ First Sundays - Thursdays | a.m. ; $ Final Sundays - Thursdays | In addition to cash games, the poker room regularly holds daily tournaments and is also home to a number of tournament festivals, including the Maryland. Poker · Tournaments · September High Hand Giveaway · Bad Beat Jackpot · Big Stax · Game Types · Live Game Report · Hotel · Contact Poker Room. Sign up for Live! Rewards® and earn up to $50 in Free Slot Play, Direct Bets or Comps. Plus, everyone gets a free Tote Bag! The casino also offers Giant Jackpots, the first slots jackpot of its kind in the State of Maryland. This mystery slot progressive jackpot is guaranteed to hit. Discover a wide range of real money poker tournaments at BetMGM. From daily Maryland Sportsbook Promos Massachusetts Sportsbook Promos Michigan. promotions and tournaments. My strategic insights help maximize revenue and enhance customer satisfaction, ensuring that our poker room remains a leader in. Maryland Live! poker tournament schedule and information, including starting times, buy-ins, prize pool guarantees, and freerolls. $10, Live Poker Giveaway. 1PM-5PM. Earn entries from August September 21 for live poker time played (Cash for Hours) and qualifying weekly high hands. Upcoming Promotions ; $ Daily High Hands. Dates & Times May Vary ; $ First Sundays - Thursdays | a.m. ; $ Final Sundays - Thursdays |

They also run decent high hand promotions if you are into those. Poker comp rate around a dollar an hour. It's my go to room. New to table games? Learn at your own pace with a live dealer and lower table limits. Play a variety of games including Craps, Roulette, Mini Baccarat, and. Live Poker Room Maryland ; July 6 at AM · 65 Views. Brenda Persian and 2 others ; June 28 at AM · 85 Views. Penny Winkler and Megan ; June 24 at AM. September's Tournaments and Promotions. @LivePokerRoom. Labor Day Black Chip Bounty MegaStacks Multi-Flight The Return of Live! Stacks Mystery Cash. SEPTEMBER TOURNAMENTS ✓Labor Day Black Chip Bounty! ✓The MegaStack Multi! ✓Live! Stacks Returns! PokerFest Tournament Series Returns Oct. ! Schedule to be. Play hundreds of slots and video poker machines, try world-class betting at Maryland's only full-service Caesars Sportsbook, and much more. Dealer spreading. Hottest High Hands! Every Minutes ; Tournaments ; $10, Live Poker Giveaway. 1PM-5PM ; Cash For Hours ; Chesapeake Overlook Fall Tournament. Noon. Live! Casino & Hotel Maryland has hosted the Maryland State Poker Championship several times. Typically, the tournament series takes place in January and. Overview; Tournaments. MGM National Harbor Details. MGM National Harbor in Oxon Hill is one of the premier places to play live poker in Maryland and on the. The 2 rooms are comfortable, except for the tables too close to the casino noise. The biggest problem are the waits for cash games. All new Live! Rewards® members will earn up to $40 more in Free Slot Play, Direct Bets, or Comps based on their play. Valid only at Live! Casino & Hotel. Find the best Maryland casino and Maryland poker room promotions and full details on the state's daily poker tournaments. Live! Casino & Hotel, No-limit. Live! Casino & Hotel Maryland is looking for talented, energetic individuals Poker Promotions · Poker Tournaments · Sports Betting · Headliners · Live. Enjoy gaming at Ocean Downs Casino in Ocean City, MD like slots, table games, and poker promotions-oxford-icon. Promotions. Upcoming Tournaments · Maryland Live! am - Aug Maryland Live! $ NL Holdem · Maryland Live! pm - Aug Maryland Live! $ NL Holdem · Maryland. Play hundreds of slots and video poker machines, try world-class betting at Maryland's only full-service Caesars Sportsbook, and much more. Dealer spreading. Earn $ SLOT DOLLARS ® or Tier Credits from TablePlay on the previous Saturday, Sunday, or promotional day to qualify for a gift that week. All SLOT. Live! Poker Room's posts ; August Tournament Calendar. @LivePokerRoom. The Maryland State Poker Championships Sponsored by. @PokerStarsUSA. 18 Events Over. Bravo Poker Live makes it a breeze to check out the current live action and tournaments in local poker rooms utilizing the Bravo poker room management and.

Large Cap Etf Dividend

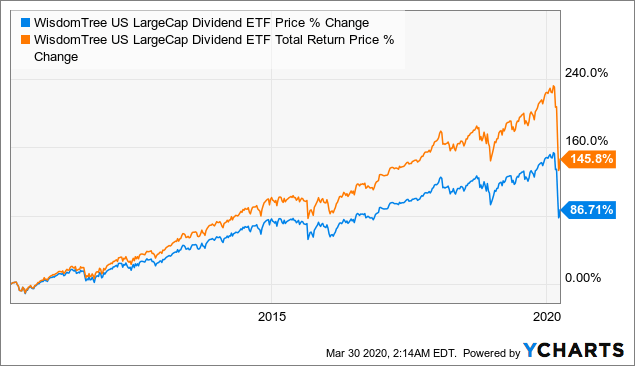

Dividend income and capital gains. Type, $/Share, Payable date, Record date, Ex-dividend date. Dividend, $, 07/02/, 06/28/, 06/28/ Dividend. US Large-Cap ETF/Schwab Strategic Trust Dividend Payment History ; Jun. 20, /20/23, Jun. 21, /21/23, Jun. 22, /22/23 ; Mar. 21, /21/23, Mar. Vanguard High Dividend Yield Index ETF, Equity, $56,, %, ,, $, %, %, %, %, %, %, Large Cap Blend Equities, Large-Cap Index as its starting universe of eligible securities. SDOG provides high dividend exposure across 10 sectors of the market by selecting the. VV's dividend yield currently ranks # of vs. its peers in the Large Cap Blend ETFs category. Rank, Symbol, Name, Dividend Yield. Vanguard Large Cap ETF/Vanguard Index Funds Annual Stock Dividends ; , ; , ; , ; , Pacer Metaurus US Large Cap Dividend Multiplier ETF. A strategy driven exchange traded fund that aims to provide cash distributions equal to % of the. The ALPS | O'Shares U.S. Quality Dividend ETF (OUSA) is designed to provide cost efficient access to a portfolio of large-cap and mid-cap high quality, low. Schwab U.S. Large-Cap ETF. Type: ETFs Symbol: SCHX Total Pre-liquidation figures include taxes on fund's distributions of dividends and capital gains. Dividend income and capital gains. Type, $/Share, Payable date, Record date, Ex-dividend date. Dividend, $, 07/02/, 06/28/, 06/28/ Dividend. US Large-Cap ETF/Schwab Strategic Trust Dividend Payment History ; Jun. 20, /20/23, Jun. 21, /21/23, Jun. 22, /22/23 ; Mar. 21, /21/23, Mar. Vanguard High Dividend Yield Index ETF, Equity, $56,, %, ,, $, %, %, %, %, %, %, Large Cap Blend Equities, Large-Cap Index as its starting universe of eligible securities. SDOG provides high dividend exposure across 10 sectors of the market by selecting the. VV's dividend yield currently ranks # of vs. its peers in the Large Cap Blend ETFs category. Rank, Symbol, Name, Dividend Yield. Vanguard Large Cap ETF/Vanguard Index Funds Annual Stock Dividends ; , ; , ; , ; , Pacer Metaurus US Large Cap Dividend Multiplier ETF. A strategy driven exchange traded fund that aims to provide cash distributions equal to % of the. The ALPS | O'Shares U.S. Quality Dividend ETF (OUSA) is designed to provide cost efficient access to a portfolio of large-cap and mid-cap high quality, low. Schwab U.S. Large-Cap ETF. Type: ETFs Symbol: SCHX Total Pre-liquidation figures include taxes on fund's distributions of dividends and capital gains.

The BlackRock Advantage Large Cap Income ETF seeks consistent income with lower volatility than the broader U.S. equity market. Legal Name. Syntax Stratified LargeCap ETF ; Fund Family Name. Syntax ; Inception Date. Jan 01, ; Shares Outstanding. ; Share Class. N/A. Our multidimensional approach to value investing includes a focus on value stocks, dividend growers, and cash-flow generators. Learn more now. dividend date. A style-pure large cap growth solution that leverages the best of J.P. Morgan's growth platform. An actively managed transparent ETF, JGRO. Vanguard Large-Cap ETF (VV) Dividend History. Data is currently not available. Ex-Dividend Date 06/28/ Dividend Yield %. Annual Dividend $ Dividend Frequency. Large Blend. Morningstar Category. CIBC Human Capital Index. Benchmark. ,, Implied Liquidity™ (Shares). disclaimer. Timothy Plan's High Dividend Stock ETF is an exchange traded fund that employs a proprietary volatility weighting methodology for a broader exposure among. Dividend ETFs seek to provide high yields by investing in dividend-paying stocks. Dividend ETFs are often categorized by their long-term growth potential or. The best global dividend ETF by 1-year fund return as of ; 1, Franklin Global Quality Dividend UCITS ETF, +% ; 2, Fidelity Global Quality Income. The index is designed to select securities with high dividend yields. The index includes securities in the Russell ® Index with high dividend yields and. Consider DOL, an ETF that seeks to provide exposure to the large-capitalization segment of the dividend-paying within developed international markets. It seeks to provide investment results that track the performance of the Nasdaq Victory US Large Cap High Dividend Volatility Weighted Index before fees and. The S&P High Dividend Index is designed to measure the performance of the top 80 high dividend-yielding companies within the S&P ® Index, based on. Calvert US Large-Cap Core Responsible Index ETF ; CVLC. CUSIP: R ; MORNINGSTAR CATEGORY Large Blend ; Market Price. as of 08/20/ ; $ ; Market Price. The iShares Core High Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities. The Nuveen ESG USA High Dividend Yield Index is based on the MSCI USA index, its parent index, which captures large-cap and mid-cap securities of the U.S. Dividend ETF from VanEck screens high-dividend stocks with Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index (MSDMDLGE). Day SEC Yield is calculated using the net income (interest and dividends) per share earned over a trailing day period (annualized), divided by the fund's. Dividend ETF List: ETFs ; DGRW, WisdomTree U.S. Quality Dividend Growth Fund, WisdomTree ; NOBL, ProShares S&P Dividend Aristocrats ETF, ProShares ; RDVY.

When Are The Cheapest Days To Buy Plane Tickets

What Day of the Week Is Best to Buy Airline Tickets? You may have heard that Tuesdays are the cheapest days to book flights. Unfortunately, that's not exactly. FLIGHTS STARTING FROM $ Low fares extended! Now save through November 17, with our Labor Day week sale! *Buy by 9/2/ Fly select days of the week. Tuesday and Wednesday are generally the cheapest days to book flights because airlines often release new fare sales on Mondays, which are then. Usually, the earlier you book your plane tickets, the cheaper they will be. Besides, if you have some wiggle room as regards dates and times of flights, you'll. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Traveling to Hawaii during the Islands' “shoulder” months of April, May, September and October means you may find more affordable deals and less crowded beaches. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. The most expensive day to book a flight is on Friday. Travelers who book on a Sunday instead of a Friday can save around 8 percent on their flights. The Cheapest Day to Buy a Domestic Flight is on a Thursday The experts talk a lot about catching the airlines on sale days, touting Tuesday as the moment when. What Day of the Week Is Best to Buy Airline Tickets? You may have heard that Tuesdays are the cheapest days to book flights. Unfortunately, that's not exactly. FLIGHTS STARTING FROM $ Low fares extended! Now save through November 17, with our Labor Day week sale! *Buy by 9/2/ Fly select days of the week. Tuesday and Wednesday are generally the cheapest days to book flights because airlines often release new fare sales on Mondays, which are then. Usually, the earlier you book your plane tickets, the cheaper they will be. Besides, if you have some wiggle room as regards dates and times of flights, you'll. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Traveling to Hawaii during the Islands' “shoulder” months of April, May, September and October means you may find more affordable deals and less crowded beaches. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. The most expensive day to book a flight is on Friday. Travelers who book on a Sunday instead of a Friday can save around 8 percent on their flights. The Cheapest Day to Buy a Domestic Flight is on a Thursday The experts talk a lot about catching the airlines on sale days, touting Tuesday as the moment when.

What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. Save money on airfare by searching for cheap flight tickets on KAYAK. KAYAK searches for flight deals on hundreds of airline tickets sites to help you find the. October is the cheapest month to fly to Plan. This coincides with the low season when fewer people travel. Whichever month you travel in, though, be sure to. I've always had the best luck flying out & in on a Saturday, booking on a Tuesday. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. Did you know there is a day of the year where airlines discount their flights? Yes August 23rd is National Cheap Flight Day. You can book your upcoming. We use the most up-to-date intelligence so that you can take advantage of the best deals and share our knowledge on the cheapest time to book flights! Here is a. Fares can vary day-to-day, based on demand. Fares are usually lower on Tuesdays, Wednesdays and Saturdays and highest on Fridays and Sundays. Flights later in. A Tuesday flight ten days before Christmas might be 75% cheaper than a Sunday flight four days before the holiday. buy tickets and don't look back. Ask anyone the best day of the week for booking flights and they will probably say Tuesday. Is this actually true or an urban myth? To some extent, it is true. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. For both U.S. domestic and international travel, Sundays can be cheaper for airline ticket purchases. Fridays tend to be the most expensive day to book a flight. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. You can even check for flights departing today. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a. Flying midweek or on Saturdays generally yields lower fare prices while Sundays, Fridays, and Mondays can be expensive flying days. At the airport, visit. This season usually starts around the middle of January and extends until the end of May. Similar patterns in ticket prices are also observed from the 10th of. Flight deals from Delta let you travel the world on a budget. Take advantage of these airfare discounts and book cheap plane tickets today at igrat-sloty-online.ru Resources show that booking at an exact time on an exact day to get cheaper airfare is a myth. Airline flights fluctuate depending on a variety of economic. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will.

401k Tutorial

A self-employed (k)—sometimes called a solo(k) or an individual (k)—is a type of savings option for small-business owners who don't have any. Safe Harbor k Guide for Your Small Business. Guide. (k) Plan Details. Personal Finance. An Employee Guide to (k) Plans. View All Resources. Discover. Helps you keep your (k) plan in compliance with important tax rules. (k) Fix-it Guide Tips on how to find, fix and avoid common errors in (k) plans. Making the (k) simpler and more affordable, so more people can have one. Give employees the retirement they deserve, at no cost to you. CBIZ InR makes it easier for you to plan and research those decisions with confidence. Below is a selection of articles and calculators that can help guide you. A (k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute a portion of his or her paycheck into a tax-advantaged. A (k) plan is a retirement savings account that allows an employee to divert a portion of each paycheck salary into long-term investments. This guide will provide you with the information you need to establish a retirement plan that suits your needs and goals. Your step-by-step guide to saving as much as possible in your (k) and other retirement accounts. A self-employed (k)—sometimes called a solo(k) or an individual (k)—is a type of savings option for small-business owners who don't have any. Safe Harbor k Guide for Your Small Business. Guide. (k) Plan Details. Personal Finance. An Employee Guide to (k) Plans. View All Resources. Discover. Helps you keep your (k) plan in compliance with important tax rules. (k) Fix-it Guide Tips on how to find, fix and avoid common errors in (k) plans. Making the (k) simpler and more affordable, so more people can have one. Give employees the retirement they deserve, at no cost to you. CBIZ InR makes it easier for you to plan and research those decisions with confidence. Below is a selection of articles and calculators that can help guide you. A (k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute a portion of his or her paycheck into a tax-advantaged. A (k) plan is a retirement savings account that allows an employee to divert a portion of each paycheck salary into long-term investments. This guide will provide you with the information you need to establish a retirement plan that suits your needs and goals. Your step-by-step guide to saving as much as possible in your (k) and other retirement accounts.

To learn more about ESG investing, check out the Vanguard ESG investing guide and the Morningstar ESG fund screener. Back to top. Get investment advice. Want to learn more about Schwab's Individual (k) plans? Download our guide Guide") and any amendments to the Guide for comprehensive details on fees. Making the (k) simpler and more affordable, so more people can have one. Give employees the retirement they deserve, at no cost to you. Guideline's full-service (k) plans make it easier and more affordable for growing businesses to offer their employees the retirement benefits they. A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. Solo k Plans For Self-Employed Business Owners. $ FLAT ANNUAL FEE, NO TRANSACTION FEES! Download Free Guide. best-plan-Solok. Guideline's full-service (k) plans make it easier and more affordable for growing businesses to offer their employees the retirement benefits they. (k) Fix-It Guide. A (k) plan is an investment option employers can offer workers to help them save for retirement. Learn more about how American Funds can help you. For each $1 you add as pretax or Roth after-tax contributions to your (k), Adobe will contribute 50 cents, up to 6% of your eligible pay, each pay period. If. If your company offers a (k), all it takes is some paperwork to sign up and human resources is available to guide you through the process. Once you've. Your step-by-step guide to saving as much as possible in your (k) and other retirement accounts. Each has its pros and cons, which we cover in our guide to (k) rollovers. Check out your workplace benefits. For easy access to your workplace benefits with. An Individual (k) plan is available to self-employed individuals and business owners, including sole proprietors, owner-only corporations, partnerships, and. There's a lot to consider around the resources, costs, and time required (45–60 days or longer) to set up a (k) plan. Our guide walks you through it all. 2. For more details about the Bank of America (k) Plan, see the enclosed summary plan description and investment guide. Investment products: Are Not FDIC. Safe Harbor k Guide for Your Small Business. Guide. (k) Plan Details. Personal Finance. An Employee Guide to (k) Plans. View All Resources. Discover. This guide is here to help you understand everything you need to know about the (k) retirement plan. This booklet constitutes a small entity compliance guide for purposes of the. Small Business Regulatory Enforcement Fairness Act of Page 3. (K) PLANS. A (k) is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account.

How Can I Remove The Pmi From My Mortgage

*PMI removal is not guaranteed in all cases where 80% LTV is reached. 3. Recast your loan. A loan recast is another great approach to removing PMI. If a recast. You can also request to have PMI removed based on the current value of your home. This may apply based on the age of your loan, or if you've made substantial. You can typically request PMI be removed once you've reached 20% equity in your home in many cases as long as the value is verified. You will also need to be. Please use the FHA MIP Removal Request Application if your loan is FHA Insured. Eligibility Checklist: • You must be current on your mortgage payments. • No. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. Here's the deal: Mortgage lenders are required to cancel PMI once you've paid your mortgage down to 78% of your home's purchase price or after you've reached. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To. *PMI removal is not guaranteed in all cases where 80% LTV is reached. 3. Recast your loan. A loan recast is another great approach to removing PMI. If a recast. You can also request to have PMI removed based on the current value of your home. This may apply based on the age of your loan, or if you've made substantial. You can typically request PMI be removed once you've reached 20% equity in your home in many cases as long as the value is verified. You will also need to be. Please use the FHA MIP Removal Request Application if your loan is FHA Insured. Eligibility Checklist: • You must be current on your mortgage payments. • No. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. Here's the deal: Mortgage lenders are required to cancel PMI once you've paid your mortgage down to 78% of your home's purchase price or after you've reached. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To.

To remove PMI, or private mortgage insurance, you must have at least 20% equity in the home. You may ask the lender to cancel PMI when you have. Removing PMI · Your property must reach at least 20% equity—or 80% LTV—to be eligible for an early cancellation. · Also, other conditions may apply to early. Pay Your Mortgage As You Wait For Automatic Cancellation · Request for PMI cancellation · Refinance the Mortgage. A borrower can ask to have PMI cancelled when they have paid down the mortgage balance to the aforementioned 80% of the homes' original appraised value. The loan servicer should automatically remove it once you reach 22% ownership (as long as your current on your payments). Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. If for some reason PMI was not canceled by request or automatic termination, the loan servicer must cancel mortgage insurance by the first day of the month. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. First, you have the right to request the removal of PMI when your principal loan balance is scheduled to fall below 80% of your home value. You can find this. The very first step to remove Private Mortgage Insurance is to contact the mortgage servicer and request the details regarding PMI cancellation. They will most. When your principal loan balance reaches 78% of the home's original value, your PMI will automatically terminate. Additionally, if you reach the halfway point. So, how much equity do you need to remove private mortgage insurance? The lender may automatically remove PMI from your mortgage once you reach 22% equity. Rising property values mean many homeowners may have enough equity in their home to refinance and reduce or remove their private mortgage insurance (PMI) or. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination. Request PMI. (A number of "higher risk" mortgage loans are not included.) The good news is that you can cancel your PMI yourself (for a loan closing after July '99). Can I remove PMI from my mortgage? Yes, you might be able to cancel your private mortgage insurance (PMI). As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. The other primary option for getting rid of FHA mortgage insurance is to put down at least 10% upfront. If you do, your lender should automatically cancel your. What is PMI and how can I remove it from my loan? The Homeowners Protection Act gives you the right to request private mortgage insurance cancellation when. For current FHA loans you cannot remove the PMI. PMI for these loans are for life if it you have it on your loan. FHA terms were changed about.

1099 For Interest

IRS Form tells the IRS about interest and gains that may be subject to federal tax. If you have questions about the information on your , consult the. Mini Cart · Laser 1-UP Transmittal Extras · INT (INTEREST) Laser 2-UP 3-Part · INT (INTEREST) Laser 2-UP 3-Part KIT w/ · INT (INTEREST). The Internal Revenue Service (IRS) requires the Department to issue Form INT to taxpayers that received interest of $ or more on refunds paid during the. Taxable interest appears on Form INT. Box 1 of the form shows the interest income earned from the issuer. What Is the Tax Rate on Interest Income? The. Enter any interest income you received from banks or from investments. Usually, your interest income is reported on Form INT, but you don't need a Form. Yes, the interest you received on a Wisconsin refund is taxable whether or not you received a Form INT from the department. Can I view my Form G. You should receive a Form INT Interest Income from banks and financial institutions if you earned more than $10 in interest for the year. Form INT data entry ; Box 3 - Interest on U.S. Savings Bonds and Treasury obligations. Income > B&D. Interest Income ; Box 4 - Federal income tax withheld. You get a Form INT for the year in which you get the interest. (INT stands for "interest." The INT tells you how much interest the bond earned.). IRS Form tells the IRS about interest and gains that may be subject to federal tax. If you have questions about the information on your , consult the. Mini Cart · Laser 1-UP Transmittal Extras · INT (INTEREST) Laser 2-UP 3-Part · INT (INTEREST) Laser 2-UP 3-Part KIT w/ · INT (INTEREST). The Internal Revenue Service (IRS) requires the Department to issue Form INT to taxpayers that received interest of $ or more on refunds paid during the. Taxable interest appears on Form INT. Box 1 of the form shows the interest income earned from the issuer. What Is the Tax Rate on Interest Income? The. Enter any interest income you received from banks or from investments. Usually, your interest income is reported on Form INT, but you don't need a Form. Yes, the interest you received on a Wisconsin refund is taxable whether or not you received a Form INT from the department. Can I view my Form G. You should receive a Form INT Interest Income from banks and financial institutions if you earned more than $10 in interest for the year. Form INT data entry ; Box 3 - Interest on U.S. Savings Bonds and Treasury obligations. Income > B&D. Interest Income ; Box 4 - Federal income tax withheld. You get a Form INT for the year in which you get the interest. (INT stands for "interest." The INT tells you how much interest the bond earned.).

A tax Form INT is a type of Form issued by US payors to a customer who is a US person that received at least $10 USD in interest during the calendar. Yes. All taxable interest income should be included, no matter how little the amount is. Your bank should send you a Form INT. Even if you do not receive Form INT from other sources, you must report any taxable interest income on your tax return. OID reports any taxable OID. Frequently asked questions (FAQs) in regard to Interest & Dividends Tax (I&D) Why did I receive a NH Form G and what should I do with it? The New. If you receive $10 or more in interest, you will receive a Form INT. This form shows the amount of interest you received, any taxes withheld, and if any of. Any financial institution who generated and paid interest income of any kind over $10 will be required to prepare and file Forms INT to report those income. File INT Form online to report the interest income to the IRS with Tax2efile at the best price. Register with us today and complete INT in. You must file a Form INT for each person you paid amounts reportable in Box 1, for Interest Income, Box 3, for Interest on U.S. Savings Bonds and Treasury. Form INT, Interest Income. Form INT is for taxable interest. Sometimes banks issue these forms to nonresident aliens who are not subject to tax on. (For example: If your account does not receive at least $10 in interest, you won't receive a INT form.) You should review the IRS guidelines to see if. A: Forms G and INT are reports of income (refunds, including interest, or overpayment credits) you received from the Department of Revenue during a. Form INT, also known as the "Interest Income" form, is a tax document that financial institutions and other payers use to report interest income of $10 or. Form INT is used to report interest income received by an individual or business during the tax year. Interest totaling $ or more, you'll receive an IRS INT form in January following the year your claim was paid. The cash value of securities, you'll. If you have interest or dividend income to report, whether reported to you on a form or not, you can enter the information into the. The INT is used to report interest income of $10 or more (in boxes 1, 3 and 8) from certain types of accounts. The federal tax laws require brokerage firms, mutual funds, and other entities to report on Form all investment income, usually interest or dividends. igrat-sloty-online.ru: INT Tax Forms Interest Income Set, 25 Pack, Great for QuickBooks and Accounting Software, INT Office Products. Form INT reports interest from banks, brokerages, and other financial institutions. Here's how to enter a INT. Yes, the interest you received on a Wisconsin refund is taxable whether or not you received a Form INT from the department. Can I view my Form G.

I Need An Uber Ride Now

I can't imagine what the point of Uber reservations are if anyone can cancel any time on you with no backup, help, or recouping anything if you are left. GoGoGrandparent gives me some degree of independence now, since I can no longer drive. I love this service. -Judie, a GoGo customer. "My rides have been good. Borrow a car by the hour, day, week or longer – you only pay for the time you've booked. Currently available in select cities. Whether you need a car today or. Do you need a ride to and from a Brightline station? Request a Brightline+ ride from Uber or hop on a complimentary shuttle today. How Do I Become an Uber Driver? Now that you are aware of the basic requirements. Let us closely discuss the steps you'll need in order to start. Step 1. In order to request your ride, regardless of if it is your first time using Uber or not, you need to enable location services on your device. Uber uses your. Join the millions of riders who trust Uber for their everyday travel needs. Whether you're running an errand across town or exploring a city far from home. Learn how you can leverage the Uber platform and apps to earn more, eat, commute, get a ride, simplify business travel, and more. Complete your plans today by reserving a ride. Book your ride up to 90 days ahead with Uber Reserve, so getting there is the last thing on your mind. I can't imagine what the point of Uber reservations are if anyone can cancel any time on you with no backup, help, or recouping anything if you are left. GoGoGrandparent gives me some degree of independence now, since I can no longer drive. I love this service. -Judie, a GoGo customer. "My rides have been good. Borrow a car by the hour, day, week or longer – you only pay for the time you've booked. Currently available in select cities. Whether you need a car today or. Do you need a ride to and from a Brightline station? Request a Brightline+ ride from Uber or hop on a complimentary shuttle today. How Do I Become an Uber Driver? Now that you are aware of the basic requirements. Let us closely discuss the steps you'll need in order to start. Step 1. In order to request your ride, regardless of if it is your first time using Uber or not, you need to enable location services on your device. Uber uses your. Join the millions of riders who trust Uber for their everyday travel needs. Whether you're running an errand across town or exploring a city far from home. Learn how you can leverage the Uber platform and apps to earn more, eat, commute, get a ride, simplify business travel, and more. Complete your plans today by reserving a ride. Book your ride up to 90 days ahead with Uber Reserve, so getting there is the last thing on your mind.

What if I need to cancel my scheduled ride? Sometimes life happens and Now, you no longer have to wake up or be ready an extra hour early in hopes. Join the millions of riders who trust Uber for their everyday travel needs. Whether you're running an errand across town or exploring a city far from home. Today's leading ride-hailing app by far, Uber Technologies was founded Taxi companies have claimed that because Uber avoids their expensive license. Caregivers don't need to worry about their own transportation or parking. Help improve access to care. Get started now. Uber Health. Visit Help Center · Do. Don't forget you can now ride with Uber without using the app. Simply call to book a trip on demand or pre-book up to 90 days in advance. Link your Marriott Bonvoy® and Uber accounts today to earn 1, bonus points on your first qualifying ride with Uber. need to download the Uber app as well. Tap 'Ride Now' for immediate pickup, or tap 'Ride Later' to reserve a ride Uber, Chicago Taxis Expand Partnership That Allows Taxi Drivers To Pick Up Riders. By proceeding, you consent to get calls, WhatsApp or SMS messages, including by automated dialer, from Uber and its affiliates to the number provided. Need a car to drive with Uber? Rentals now available with Hertz Rental Car. Get 6% cash back on all Uber rides, and free stuff every day of the week See how I have 5 stars? Very demure, very mindful. I'm not like you other. Call USE-UBER to request a ride on demand or in advance through Uber, the ride option that keeps you moving forward. How to ride with Taxi · 1. Request. Open the app and enter your destination in the “Where to?” box. · 2. Ride. Check that the vehicle details match what you see. Because drivers would refuse many more rides than they do now. The states need to force the rideshare platforms to pay at least 60% of the fare. Rideshare with Lyft. Lyft is your friend with a car, whenever you need one. Download the app and get a ride from a friendly driver within minutes. Now there's no need to rearrange your schedule, spend time in traffic, or stop what you're doing to pick up a loved one. Save time—and your sanity. Gift. By proceeding, you consent to get calls, WhatsApp or SMS messages, including by automated dialer, from Uber and its affiliates to the number provided. Text. For more information on using Uber to request a ride, visit the Uber Support Center. Using Uber is now easier. need. Business profile has been removed. Uber rides that begin and end. Uber riders will have the option now to pay to not speak to their drivers. . Jeff Chiu/AP.) Ride hailing company Uber has. You now lose out on anything you would have made that day, and the next. For some, that is hundreds of dollars of lost income, due to a false. Sign Up Now. If you're already a RIDE customer, you can Our RIDE Flex partners Uber and Lyft have lifted their mask mandates for drivers and riders.

Average Home Loan Percentage Rate

Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April. As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. The national average mortgage rate is % Find out what your personal rate could be. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April. As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. The national average mortgage rate is % Find out what your personal rate could be. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year fixed mortgage rate is down by View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Friday. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! New home purchase ; year fixed mortgage · % ; % first-time-homebuyer · % ; year first-time homebuyer with year balloon · % ; Construction. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. September mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Compare Current Mortgage Rates As of August 30, , the average year-fixed mortgage APR is %. Terms Explained. Compare APRs: When comparing mortgage rates and lenders, it's crucial to look at the annual percentage rate (APR) along with the interest rate. Lender A might. Customized mortgage rates ; year fixed, % (%), $ credit to closing costs, $3, ; year fixed, % (%), $ added to closing costs. Visit Citizens for today's home mortgage rates. Explore our and year home mortgage rate options to find the one for you. Citizens will be there every. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate.

Debt Versus Equity Financing

Debt financing is exactly that, the company borrows the money and agrees to pay it back according to a specific schedule. Upvote. There are plenty of options for businesses looking for financing. Equity financing is the main alternative to debt-conscious business owners. Debt financing means you're borrowing money from an outside source and promising to pay it back with interest by a set date in the future. Equity financing. Equity loans are provided in return for an ownership stake in the company and therefore are not expected to be repaid on a fixed schedule -- or even at all. Debt financing involves borrowing a fixed sum from a lender, which is then paid back with interest. Equity financing is the sale of a percentage of the. If so, then equity funding is better, as debt funding is purely transactional where you borrow money and then you pay it back with the interest payments. On the. The Cost of Equity is generally higher than the Cost of Debt since equity investors take on more risk when purchasing a company's stock as opposed to a. Equity and debt financing, alone or in combination, are useful strategies to provide funding for working capital, growth, and mergers and acquisitions. The biggest difference between debt financing and equity financing is the value exchange between the business raising the money and the lender providing the. Debt financing is exactly that, the company borrows the money and agrees to pay it back according to a specific schedule. Upvote. There are plenty of options for businesses looking for financing. Equity financing is the main alternative to debt-conscious business owners. Debt financing means you're borrowing money from an outside source and promising to pay it back with interest by a set date in the future. Equity financing. Equity loans are provided in return for an ownership stake in the company and therefore are not expected to be repaid on a fixed schedule -- or even at all. Debt financing involves borrowing a fixed sum from a lender, which is then paid back with interest. Equity financing is the sale of a percentage of the. If so, then equity funding is better, as debt funding is purely transactional where you borrow money and then you pay it back with the interest payments. On the. The Cost of Equity is generally higher than the Cost of Debt since equity investors take on more risk when purchasing a company's stock as opposed to a. Equity and debt financing, alone or in combination, are useful strategies to provide funding for working capital, growth, and mergers and acquisitions. The biggest difference between debt financing and equity financing is the value exchange between the business raising the money and the lender providing the.

Find the Right Mix of Debt vs Equity Financing · Using your personal savings. · Money from family and friends. · Angel investors. · Crowdfunding for equity or. Debt financing provides immediate access to capital while allowing business owners to maintain full control and ownership. On the other hand, equity financing. The cost of debt financing is therefore lower than the cost of equity. However the big disadvantage of debt financing is that it increases the level of risk in. There are plenty of options for businesses looking for financing. Equity financing is the main alternative to debt-conscious business owners. Unlike debt financing, equity financing mitigates the risk of default since there's no obligation to return the investors' money in the case of business failure. Debt finance is preferable if you can accept the repayments, as it may end up costing you less than equity finance in the long run. Ininequity finance, there is no responsibility to pay back the moneythat is obtained. On the other hand, debt financing necessitates thatthe firm's owners pay. Debt and equity financing both offer the funding small businesses need to launch and grow, but each comes with its own set of pros and cons. Debt financing and equity infusion have very different effects on your balance sheet, income, cash flow, and taxes. While debt is taxed once, equity funding is taxed twice: once at the business level, and once at the shareholder level through dividend and capital gains taxes. Business owners can utilize a variety of financing resources, initially broken into two categories, debt and equity. "Debt" involves borrowing money to be. On the other hand, equity financing involves raising capital by selling shares of the company to investors. This means that investors provide funds in exchange. In this tutorial, you'll learn how to analyze Debt vs. Equity financing options for a company, evaluate the credit stats and ratios in different operational. The difference between debt financing and equity financing is that debt involves borrowing money for a specific period, which the business must repay with. Retain ownership: With debt financing, the lender or creditor does not receive any shares or ownership of the company. With equity financing, the company sells. It may be a good option as long as you plan to have sufficient cash flow to pay back the principal and interest. The major advantage of debt financing over. Debt financing refers to the borrowing of loans from other companies, banks, or financial institutions in order to support a business's operations. The loan. The cost of debt financing is therefore lower than the cost of equity. However the big disadvantage of debt financing is that it increases the level of risk in. Do you want a small business loan or investors? Take a look at the pros and cons of debt versus equity finance for funding your small business. Debt financing costs less and leaves the company with more control. More about equity financing. Privately owned small and medium-sized companies can find it.