igrat-sloty-online.ru News

News

How Long To Get 501c3 Status

How Long Does It IRS Publication details the rules and regulations that have to be followed by an organization in order to gain tax-exempt status. When is an organization's tax-exempt status effective? If an organization files its application for recognition as a tax-exempt organization within 27 months of. Under IRS regulations all new (c)(3) groups are automatically classified as public charities for the first five years as long as they demonstrate in their. You will receive your confirmation by U.S. Mail. It will be addressed to the mailing address you provided on the application. How long does it take for my. Make a mistake in any of this and your application will be delayed or denied when it reaches the IRS Exempt Organizations department. More important, however. 1) Get an Employer Identification Number (EIN) In order to file for tax exemption with the IRS your nonprofit will need an “EIN” which requires completing and. Unlock your nonprofit's full potential as a (c)(3) to get exempt from federal income taxes—and let others make tax-deductible donations. tax-exempt status. There are a number of ways that a charitable organization can have its (c)(3) status revoked: 1. Failing to file a Form with the. Step 1: Incorporate before applying for tax-exempt status · Step 2: Get an EIN · Step 3: File form with the IRS · Step 4: Ensure your (c)(3) also has tax-. How Long Does It IRS Publication details the rules and regulations that have to be followed by an organization in order to gain tax-exempt status. When is an organization's tax-exempt status effective? If an organization files its application for recognition as a tax-exempt organization within 27 months of. Under IRS regulations all new (c)(3) groups are automatically classified as public charities for the first five years as long as they demonstrate in their. You will receive your confirmation by U.S. Mail. It will be addressed to the mailing address you provided on the application. How long does it take for my. Make a mistake in any of this and your application will be delayed or denied when it reaches the IRS Exempt Organizations department. More important, however. 1) Get an Employer Identification Number (EIN) In order to file for tax exemption with the IRS your nonprofit will need an “EIN” which requires completing and. Unlock your nonprofit's full potential as a (c)(3) to get exempt from federal income taxes—and let others make tax-deductible donations. tax-exempt status. There are a number of ways that a charitable organization can have its (c)(3) status revoked: 1. Failing to file a Form with the. Step 1: Incorporate before applying for tax-exempt status · Step 2: Get an EIN · Step 3: File form with the IRS · Step 4: Ensure your (c)(3) also has tax-.

Note to OP: check that this hasn't happened before. If it has, you do not qualify for a EZ and must do the long form, which includes. For organizations that have existed for at least five (5) years, the applicant must provide financial data for the last five (5) years. For new organizations. Some organizations that have obtained tax-exempt status from the Internal So long as the entity would otherwise continue to exist, the entity can. While (c)(3) public charities are exempt from Federal income tax, most of these organizations have information reporting obligations under the Internal. Obtain IRS (c)(3) status. Take care of state compliance issues. The majority of (c)(3) nonprofits qualify for tax-exempt status through nonprofit. get a c3 status, but patience is key. The nonprofit I helped start had to wait 18 months to get c3 status, and we also received notice that they "didn. We've helped hundreds of churches, ministries and other nonprofits get their tax exempt status nationwide. Packages that include all you need to get started. This means that if you do it wrong and the IRS does not grant you (c)(3) status, then you have to refile it and wait again. That is at least half of a year. A two-year IRS study looks at the main reasons why EZ applications are rejected. EZ is the shorter, less expensive way to apply for tax-exempt status. non-profit, or because the entity has received tax-exempt status from the IRS. Non-profits that have employees and buy and sell goods or services are. If your nonprofit has more than $50, in annual revenue, or if this is not the first time the tax exempt status has been revoked, retroactive reinstatement. You might find the following additional information useful when applying for recognition of tax-exempt status under Section (c)(3): If you don't have an. have some specific requirements that must be Please contact the MSTC or consult a tax advisor for further information on obtaining tax-exempt status. receive service of process on behalf of the nonprofit association. The filing of Questions about federal tax-exempt status? Contact the IRS Exempt. Distinguishable: You may choose any name as long as it is distinguishable If you intend to apply for federal tax-exempt status, you must elaborate on. How Long Does It Take for the IRS To Reinstate Tax-Exempt Status? The timeframe for IRS reinstatement can vary depending on various factors, including the. Nonprofit organizations have chosen to undertake programs to benefit members However, these organizations are few and far between. Most nonprofit. Churches and religious organizations that meet the requirements of (c)(3) of the IRC but are not required to apply for and obtain tax-exempt status from the. You'll also need to budget months to complete the application process, which might involve answering additional questions from the IRS. But if you have the. A nonprofit corporation that wishes to apply for tax exempt status (c) (3) to the Internal Revenue Services (IRS), should not use this form for its.

Will The Price Of Gold Go Up

The initial demand area is seen at the $2, threshold for Gold price, below which the August 23 low of $2, will be tested. How could XAU/USD move this. The gold's price rose by 14% from November to early February , supported by a less hawkish tone by the US Federal Reserve's (Fed's) Jerome Powell. Plus. Geopolitical factors may have a positive effect on gold pricing, which means that the value of gold will move in the same direction as geopolitical tension. Commodities 4 Stocks That Could Get a Lift From a Copper Price Rebound. Aug. 29, at p.m. ET by Barron's. Nymex Overview: Petroleum Futures Up After. It is not guaranteed but usually the gold price goes up when interest rates go down, and down when rates go up. This is because rising interest rates make. It is not guaranteed but usually the gold price goes up when interest rates go down, and down when rates go up. This is because rising interest rates make. In its gold price projection on 24 April ABN-Amro Group estimated the precious metal to average at $1,/oz in and rise to $1, by the end of Gold increased USD/t oz. or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. The expectation is that gold will continue to gain value. Analysts forecast consistent prices above $1, per ounce this year, with some suggesting that gold –. The initial demand area is seen at the $2, threshold for Gold price, below which the August 23 low of $2, will be tested. How could XAU/USD move this. The gold's price rose by 14% from November to early February , supported by a less hawkish tone by the US Federal Reserve's (Fed's) Jerome Powell. Plus. Geopolitical factors may have a positive effect on gold pricing, which means that the value of gold will move in the same direction as geopolitical tension. Commodities 4 Stocks That Could Get a Lift From a Copper Price Rebound. Aug. 29, at p.m. ET by Barron's. Nymex Overview: Petroleum Futures Up After. It is not guaranteed but usually the gold price goes up when interest rates go down, and down when rates go up. This is because rising interest rates make. It is not guaranteed but usually the gold price goes up when interest rates go down, and down when rates go up. This is because rising interest rates make. In its gold price projection on 24 April ABN-Amro Group estimated the precious metal to average at $1,/oz in and rise to $1, by the end of Gold increased USD/t oz. or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. The expectation is that gold will continue to gain value. Analysts forecast consistent prices above $1, per ounce this year, with some suggesting that gold –.

gold price and they will sell above the spot gold price. The spread Does the price of gold go up if the stock market goes down? The price of. Interest rates go up, gold prices go down! · When central banks announce a rise in interest rates, the price of gold generally falls. There are two reasons for. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of. Materials Up on Rate Bets -- Materials Roundup. Aug. 30, at p.m. ET. Read full story · Beyond Meat Inc. stock falls Friday, underperforms market. Aug. In December , gold prices hit $2,, reacting to a new central bank monetary policy and rising haven demand. As interest rates start to fall, prices could. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis. Gold Prediction These five years would bring an increase: Gold price would move from $3, to $4,, which is up 46%. Gold will start at. So any increase, decrease or sudden change to the supply or demand of gold will have an impact its price. For example, the largest purchases of Bullion are in. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of. (Will CLOSE in 3 hrs. 27 mins.) Aug 29, PM NY Time. Live Spot Gold go down (%)?. Did Platinum really go down (%)?. Did. Today, the demand for gold, the amount of gold in the central bank reserves, the value of the U.S. dollar, and the desire to hold gold as a hedge against. “Gold prices could surge to $4, per ounce in as interest rate hikes and recession fears keep markets volatile. The price of the precious metal could. With inflation raging and the US debt piling up, gold could move from its current price to as high as $3, (approximately £2,) per ounce throughout the. GOLD Made a Move Down, but Now Follows the H4 Predicted Bullish Move. Today move, and what the spot price of gold will be in the future. You want. Weak U.S. Consumer Discrationary Sector is bearish for gold as gold is used in jewelry. Don't miss a thing! Discover what's moving the markets. Sign up for. As a result, gold also can be considered a risky investment, as history has shown that the price of gold does not always go up, particularly when markets are. Gold Futures - Dec 24 (GCZ4) ; Prev. Close: 2, ; Open: 2, ; Day's Range: 2,, ; 52 wk Range: 1,, ; 1-Year Change: %. Higher inflation implies a weaker dollar, which implies higher commodity prices and a surge in emerging market equities. It will make bonds unattractive and. US monetary policy has already been a key factor for the gold price so far this year, and this is highly likely to continue into Tapering of bond. Gold Price, as well as several regional prices. The LBMA Gold Price is used Sign up now. Ask me later. We value your opinion - The World Gold Council would.

Depreciation Expense On Balance Sheet

Depreciation Expense is an expense account with a debit balance that records the amount of depreciation for one single accounting period, whereas Accumulated. Your accountant or tax preparer is probably your best resource for helping you take advantage of the depreciation expense on your company's balance sheet. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and equipment. Debit (income statement): Depreciation Expense ($2,); Credit (balance sheet): Accumulated Depreciation ($2,). Depreciation FAQ. What is the purpose of. balance sheet at the most recent historical period). Assuming straight-line depreciation of new fixed assets and the total depreciation expense already. The depreciation expense is reported on the income statement as a reduction to revenues and accumulated depreciation is reported as a contra account to its. Depreciation expense is the appropriate portion of a company's fixed asset's cost that is being used up during the accounting period shown in the heading of. Balance sheet depreciation calculates the decrease in the value of an asset over its useful life. It also calculates the amount of depreciation expense that. Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset's value that has been consumed during the year. Depreciation Expense is an expense account with a debit balance that records the amount of depreciation for one single accounting period, whereas Accumulated. Your accountant or tax preparer is probably your best resource for helping you take advantage of the depreciation expense on your company's balance sheet. Accumulated depreciation is under fixed assets on a balance sheet. It's a credit balance deducted from the total cost of property, plant, and equipment. Debit (income statement): Depreciation Expense ($2,); Credit (balance sheet): Accumulated Depreciation ($2,). Depreciation FAQ. What is the purpose of. balance sheet at the most recent historical period). Assuming straight-line depreciation of new fixed assets and the total depreciation expense already. The depreciation expense is reported on the income statement as a reduction to revenues and accumulated depreciation is reported as a contra account to its. Depreciation expense is the appropriate portion of a company's fixed asset's cost that is being used up during the accounting period shown in the heading of. Balance sheet depreciation calculates the decrease in the value of an asset over its useful life. It also calculates the amount of depreciation expense that. Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset's value that has been consumed during the year.

Depreciation expense refers to the expenses that are charged to fixed assets based on how much the assets get consumed during the accounting period. Subtract the accumulated depreciation on the prior accounting period's balance sheet from the accumulated depreciation on the most recent period's balance sheet. Depreciation expense for the period; Balances of major classes of depreciable assets, by nature or function, at the balance sheet date; Accumulated depreciation. It has a credit balance and is subtracted from the asset's original cost to determine its net book value or carrying value on the balance sheet. Example of. Accumulated depreciation is not an asset itself—rather, it's an account used to record the cumulative change in the value of an asset. Businesses depreciate long-term assets for both accounting and tax purposes. The decrease in value of the asset affects the balance sheet of a business or. Instead, it simply represents how much of an asset's value has been used up over time and can be deducted as an expense. Over time, the depreciation of an asset. What are the Depreciation Expense Methods? · Straight-line depreciation · Declining balance (accelerated depreciation) · Units-of-production. That amount equals the annual depreciation expense for the asset. For financial statement purposes, this amount should be applied against the business's income. It is a debit to depreciation expense– which appears on the income statement– and a credit to accumulated depreciation– which appears on the balance sheet. Depreciation expenses appear on the income statement during the recording period, while accumulated depreciation shows up on the balance sheet under related. Depreciation moves the cost of an asset from the balance sheet to Depreciation Expense on the income statement in a systematic manner during an asset's useful. Depreciation expense can impact a company's financial statements, such as its income statement and balance sheet. To reflect this reduction in value accurately on your financial statements, depreciation expense is recorded each year until the asset reaches its estimated. This also shows the asset's net book value on the balance sheet. Financial ($, – $20,) / 8 = $10, in depreciation expense per year. Accumulated. When a depreciation expense is charged to the income statement, the value of the long-term asset recorded on the balance sheet is reduced by the same amount. Accumulated depreciation is a contra-asset account. It is presented in the balance sheet as a deduction to the related fixed asset. Here's a table illustrating. In summary, on the income statement, depreciation is an expense that reduces the company's earnings, while on the balance sheet, it is a contra-asset account. Since the original cost of a long‐lived asset should always be readily identifiable, a different type of balance‐sheet account, called a contra‐asset account. Depreciation, or the decrease in value of a company asset, is reported on financial statements. Learn the definition of depreciation and explore the differences.

Top Rated Discount Brokerage Firms

Free for all trading on US securities and buying stocks on line. What is the best trading tool for traders? However, this also suits the investor who will. Though individual investors still call full-service brokers to place trades, many have now switched to fully using online discount brokerages. These online. Fidelity got the top overall score, followed by Schwab. Fidelity's fully automatic and hybrid services are standouts – reasonably priced with attractive. Category:Online brokerages · Ally Financial · Charles Schwab · Chase Bank · Citibank · E-Trade · Fidelity Investments · Firstrade Securities · Interactive Brokers. Best NRI Trading Account; Prostocks, Zerodha, and fyers are the best NRI trading discount brokers while ICICI 3-in-1 NRI Account is the best NRI. Commercial real estate companies and brokerage firms provide services for investors, owners and tenants by combining local market insight. Clever Real Estate is the top discount broker because it offers a consistent % listing fee nationwide and matches sellers with multiple experienced, full-. Some of the best ways to invest $1, will allow you to quickly increase your bankroll. 5 min read Aug 27, Charles Liang, chief. Our annual look at the top online brokers spotlights websites that beat the pack with cutting-edge technology, ease of use, and abundant functionality. Free for all trading on US securities and buying stocks on line. What is the best trading tool for traders? However, this also suits the investor who will. Though individual investors still call full-service brokers to place trades, many have now switched to fully using online discount brokerages. These online. Fidelity got the top overall score, followed by Schwab. Fidelity's fully automatic and hybrid services are standouts – reasonably priced with attractive. Category:Online brokerages · Ally Financial · Charles Schwab · Chase Bank · Citibank · E-Trade · Fidelity Investments · Firstrade Securities · Interactive Brokers. Best NRI Trading Account; Prostocks, Zerodha, and fyers are the best NRI trading discount brokers while ICICI 3-in-1 NRI Account is the best NRI. Commercial real estate companies and brokerage firms provide services for investors, owners and tenants by combining local market insight. Clever Real Estate is the top discount broker because it offers a consistent % listing fee nationwide and matches sellers with multiple experienced, full-. Some of the best ways to invest $1, will allow you to quickly increase your bankroll. 5 min read Aug 27, Charles Liang, chief. Our annual look at the top online brokers spotlights websites that beat the pack with cutting-edge technology, ease of use, and abundant functionality.

Free for all trading on US securities and buying stocks on line. What is the best trading tool for traders? However, this also suits the investor who will. What makes it great: Fidelity is another of the biggest online brokerages in the United States that makes it easy to manage all of your investments under one. FPWA, FBS and NFS are Fidelity Investments companies. Fidelity was named NerdWallet's winner for Best Broker for Beginning Investors, Best Online Broker. Best for Active Traders: LightSpeed Trading For high-volume traders, we have chosen Lightspeed, a division of Lime Brokerage. Lightspeed is known for its many. What makes it great: Fidelity is another of the biggest online brokerages in the United States that makes it easy to manage all of your investments under one. Compare online brokers and trading platforms, from commissions to online promotion. Open your trading account at MoneySmart to enjoy exclusive offers! Some well-known full-service brokerages include Charles Schwab, Fidelity, Merrill Lynch, Raymond James and Edward Jones. So what do discount brokerages have. Fidelity, Schwab and Vanguard have specific qualities that appeal to investors, which I'll discuss shortly. But they're the best overall because they charge. Investor's Business Daily: Best Online Brokers 12 Year Winner: Rated a Best Online Broker investment firms. It is independently conducted, and the. Best Stock Brokers · Fidelity Review. Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy. What's the best brokerage for ? For reference, I've been with ScottTrade, TD Ameritrade, and Schwab - all without ever changing my account. TD Ameritrade is an online broker that provides a wide range of investment vehicles. TD Ameritrade. Stocks-Short & Long, ✓. Options/Complex Options, ✓. Full-service, discount, and robo-advisory brokerages can further be broken down based on the type of account and the control they have over investment decisions. According to Morningstar and Vanguard, Vanguard's average expense ratio as of Dec. 31, , was just %. This is the lowest of any brokerage firm and well. Rated #1 - Best Online Broker Six Years in a Row by Barron's Interactive Brokers is regularly recognized as a leading, low-cost broker. Our brokerage. Stock Brokers ; Groww · Free · % ; Zerodha · ₹ · Zero ; Angel One · ₹ · Zero ; Upstox · Free · % ; ICICI Direct · ₹ · %. Commercial real estate companies and brokerage firms provide services for investors, owners and tenants by combining local market insight. The best discount brokers offer a wide range of services, low commissions, and user-friendly platforms. This article takes a look at the market's top solutions. The best discount brokers offer a wide range of services, low commissions, and user-friendly platforms. This article takes a look at the market's top solutions. RealTrends by Volume: The largest real estate brokerage firms in the United States that are ranked by closed sales volume in

Ishares S&P 500 Index Inv A

The Fund seeks to provide investment results that correspond to the total return performance of publicly-traded common stocks in the aggregate, S&P Index. Find the latest performance data chart, historical data and news for iShares S&P Index Fund - Class A (BSPAX) at igrat-sloty-online.ru iShares S&P Index Investor A BSPAX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. iShares S&P Index Investor P (BSPPX) is a passively managed U.S. Equity Large Blend fund. BlackRock launched the fund in The investment seeks. Top investors of iShares S&P Index stock ; Squarepoint Ops, M · $B ; Mariner Wealth Advisors, M · $B ; National Pension Service, M · $B. Performance charts for iShares S&P Index Fund (BSPAX) including intraday, historical and comparison charts, technical analysis and trend lines. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. iShares S&P Index Fund Investor A Shares (04/13). BSPAX. T. Rowe Price U.S. Equity Research Fund (11/94). PRCOX. The fund is a "feeder" fund that invests all of its assets in the Master Portfolio of MIP, which has the same investment objective and strategies as the fund. The Fund seeks to provide investment results that correspond to the total return performance of publicly-traded common stocks in the aggregate, S&P Index. Find the latest performance data chart, historical data and news for iShares S&P Index Fund - Class A (BSPAX) at igrat-sloty-online.ru iShares S&P Index Investor A BSPAX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. iShares S&P Index Investor P (BSPPX) is a passively managed U.S. Equity Large Blend fund. BlackRock launched the fund in The investment seeks. Top investors of iShares S&P Index stock ; Squarepoint Ops, M · $B ; Mariner Wealth Advisors, M · $B ; National Pension Service, M · $B. Performance charts for iShares S&P Index Fund (BSPAX) including intraday, historical and comparison charts, technical analysis and trend lines. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. iShares S&P Index Fund Investor A Shares (04/13). BSPAX. T. Rowe Price U.S. Equity Research Fund (11/94). PRCOX. The fund is a "feeder" fund that invests all of its assets in the Master Portfolio of MIP, which has the same investment objective and strategies as the fund.

Complete iShares S&P Index Fund;Investor A funds overview by Barron's. View the BSPAX funds market news. iShares S&P Index Investor A has securities in its portfolio. The top 10 holdings constitute % of the fund's assets. The fund meets the SEC. iShares S&P Index Fund Class K · $ WFSPX ; iShares S&P Index Fund Service Shares. $ BSPSX ; iShares S&P Index Fund Class G Shares. The Fund seeks investment results that correspond generally to the price and yield performance of the S&P Index which is composed of large-capitalization. The fund is a "feeder" fund that invests all of its assets in the Master Portfolio of MIP, which has the same investment objective and strategies as the. Last dividend for iShares S&P Index Fund - Cl (BSPAX) as of Sept. 12, is USD. The forward dividend yield for BSPAX as of Sept. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. The index measures the performance of the large-capitalization sector of the U.S. equity market, as determined by SPDJI. The fund generally will invest at. The iShares S&P Index Fund - Class K (ticker: WFSPX) is a mutual fund that seeks to track the performance of the S&P Index, a widely recognized. Shareclass ticker. BSPIX. Data as of ; Shareclass name. iShares S&P Index Institutional. % of fund assets screened ; Shareclass type. Open-end funds. Fund net. Morningstar has awarded the Fund a SILVER medal (Effective 02/08/).† Rated against 1, Large Blend Funds, as of 06/30/ The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index. ISHARES S&P INDEX FUND INVESTOR A SHARES- Performance charts including intraday, historical charts and prices and keydata. The Fund aims to achieve a return on your investment, through a combination of capital growth and income on the Fund's assets, which reflects the return of. Return After Taxes on Distributions and Sale of Fund Shares, %, %, % ; iShares S&P Index Fund — Institutional Shares ; Return Before Taxes. Get iShares S&P Index Fund Investor A Shares (BSPAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. iShares S&P Stock Index Inv A (BSPAX). Cat: Blend; Type: Min. Invest: $; Exp. Ratio: %. 84 "Excellent". Sub-MAXratings. BSPAX: iShares S&P Index Fund - Class A - Fund Profile. Get the lastest Fund Profile for iShares S&P Index Fund - Class A from Zacks Investment. The Fund pursues its investment objective by seeking to replicate the total return performance of the S&P Index, which is composed of approximately View the latest iShares S&P Index Fund;Investor A (BSPAX) stock price, news, historical charts, analyst ratings and financial information from WSJ.

Micro Mini S&P 500

Discover historical prices for MES=F stock on Yahoo Finance. View daily, weekly or monthly format back to when MICRO E-MINI S&P INDEX FUTU stock was issued. To get specific, Micro E-mini Equity Index futures – which track widely-followed indexes like the S&P , Nasdaq, Russell , and Dow Jones Industrial. Find the latest MICRO E-MINI S&P INDEX FUTU (MES=F) stock quote, history, news and other vital information to help you with your stock trading and. OrderlyThe price action seen in the S&P futures market for Monday was orderly. Huge volatility for the shortened trading session was not expected. So, the. These contracts allow market participants to gain exposure to price fluctuations in the S&P , Russell , Dow Jones 30 and Nasdaq indices at a much. Free live Micro S&P Futures streaming chart. The chart is intuitive yet powerful, customize the chart type to view candlestick patterns, area, line graph. What are Micro S&P Futures Doing Right Now? Micro S&P Futures are trading at 5, What are Index Futures? Index futures are financial contracts. Do you want to Trade the E-micro S&P for 59 cents commission regardless of account size or volume? Direct market access and co-located servers. In recent years, CME Group has introduced the Micro E-mini S&P futures contract which is 1/10th of the size of the standard E-mini S&P futures contract. Discover historical prices for MES=F stock on Yahoo Finance. View daily, weekly or monthly format back to when MICRO E-MINI S&P INDEX FUTU stock was issued. To get specific, Micro E-mini Equity Index futures – which track widely-followed indexes like the S&P , Nasdaq, Russell , and Dow Jones Industrial. Find the latest MICRO E-MINI S&P INDEX FUTU (MES=F) stock quote, history, news and other vital information to help you with your stock trading and. OrderlyThe price action seen in the S&P futures market for Monday was orderly. Huge volatility for the shortened trading session was not expected. So, the. These contracts allow market participants to gain exposure to price fluctuations in the S&P , Russell , Dow Jones 30 and Nasdaq indices at a much. Free live Micro S&P Futures streaming chart. The chart is intuitive yet powerful, customize the chart type to view candlestick patterns, area, line graph. What are Micro S&P Futures Doing Right Now? Micro S&P Futures are trading at 5, What are Index Futures? Index futures are financial contracts. Do you want to Trade the E-micro S&P for 59 cents commission regardless of account size or volume? Direct market access and co-located servers. In recent years, CME Group has introduced the Micro E-mini S&P futures contract which is 1/10th of the size of the standard E-mini S&P futures contract.

Free live streaming charts for the Micro S&P Futures. ES00 | A complete E-Mini S&P Future Continuous Contract futures overview by MarketWatch. View the futures and commodity market news, futures pricing and. In May , The CME launched micro E-mini futures contracts and the new contract wasted no time in sky-rocketing up the charts. Micro E-mini contracts are. Micro E-mini Futures launched in May and have been the most successful product launch in CME Group history. Since launch, nearly M contracts have traded. The current price of Micro E-mini S&P Index Futures is 5, USD — it has fallen −% in the past 24 hours. Watch Micro E-mini S&P Index Futures. Micro E-mini S&P Full The Micro E-mini S&P Future is a futures contract on the US S&P stock market index. It is traded on the Chicago. Since the onset, these contracts proved extremely popular. The micro e-mini S&P futures hit a volume of almost , contracts traded on June 3, Micro E-mini futures contracts provide an ideal starting point for new futures traders to start small and scale up as you become more comfortable in the live. Today's S&P E-Mini prices with latest S&P E-Mini charts, news and S&P E-Mini futures quotes. Do you want to Trade the E-micro S&P for 59 cents commission regardless of account size or volume? Direct market access and co-located servers. Mini futures are the most commonly traded for indexes, such as the S&P or Nasdaq However micro futures have become increasingly popular across all. They allow investors to take a position or speculate on the movement of underlying indexes, such as the S&P , the Dow 30, the Nasdaq , and the Russell. A point gain in the S&P would increase the value of an /ES contract by $ On the other hand, the S&P micro E-mini with the symbol /MES has a. Complete E-Mini S&P Future Continuous Contract futures overview by Barron's. View the ES00 futures and commodity market news with real-time price data. The most popular US stock index futures contract is the E-mini S&P futures contract, which is traded at the CME Group. A micro futures contract is simply a smaller version of the same futures contract. For example, the Micro E-Mini S&P contract is 1/10 the size of the. Find the Micro E-mini S&P Index Futures(SEP4) (MESMAIN) options chain including strike prices, expiration dates, and volume data on Moomoo's free online. The CME Group's product code for the micro e-Mini S&P index future is MES, MNQ for the NASDAQ index future, M2K for the Russell index and MYM for. Find the Micro E-mini S&P Index Futures(SEP4) (MESMAIN) options chain including strike prices, expiration dates, and volume data on Moomoo's free online. CME futures exchange: Micro E-mini S&P Futures (symbol: MES) Contract Specifications - including trading hours and months.

No Load Ira Mutual Funds

Consisting only of mutual funds available without a load or transaction fee through the Schwab Mutual Fund OneSource® service, the Mutual Fund OneSource Select. For funds in this group that are not subject to a mutual fund sales charge (“no-load”), this fee is $40, and for funds in this group that are subject to a. They generally have lower management and transaction costs than actively managed funds. · They typically do not have sales charges (loads) that many mutual funds. IBKR has one of the largest mutual fund marketplaces. It is is fund-agnostic and includes 40k+ funds worldwide, no custody fees and includes a robust Fund. Here are our picks for the best 25 no-load mutual funds: what makes them tick, and what kind of returns they've delivered. » IRA Mutual Fund Investors Reap the Benefits of Declining Fund Long-Term Mutual Fund Investors Have Increasingly Purchased No-Load Mutual Funds Without. $25 for each Vanguard mutual fund. The fee is waived if you have at least $5 million in qualifying Vanguard assets. As described above, however, not every type of shareholder fee is a sales load, and a no-load fund may charge fees that are not sales loads. For example, a no-. For No Load, Transaction Fee funds (TF) you will be charged a transaction fee of $ per online purchase, sale or exchange or $ if representative. Consisting only of mutual funds available without a load or transaction fee through the Schwab Mutual Fund OneSource® service, the Mutual Fund OneSource Select. For funds in this group that are not subject to a mutual fund sales charge (“no-load”), this fee is $40, and for funds in this group that are subject to a. They generally have lower management and transaction costs than actively managed funds. · They typically do not have sales charges (loads) that many mutual funds. IBKR has one of the largest mutual fund marketplaces. It is is fund-agnostic and includes 40k+ funds worldwide, no custody fees and includes a robust Fund. Here are our picks for the best 25 no-load mutual funds: what makes them tick, and what kind of returns they've delivered. » IRA Mutual Fund Investors Reap the Benefits of Declining Fund Long-Term Mutual Fund Investors Have Increasingly Purchased No-Load Mutual Funds Without. $25 for each Vanguard mutual fund. The fee is waived if you have at least $5 million in qualifying Vanguard assets. As described above, however, not every type of shareholder fee is a sales load, and a no-load fund may charge fees that are not sales loads. For example, a no-. For No Load, Transaction Fee funds (TF) you will be charged a transaction fee of $ per online purchase, sale or exchange or $ if representative.

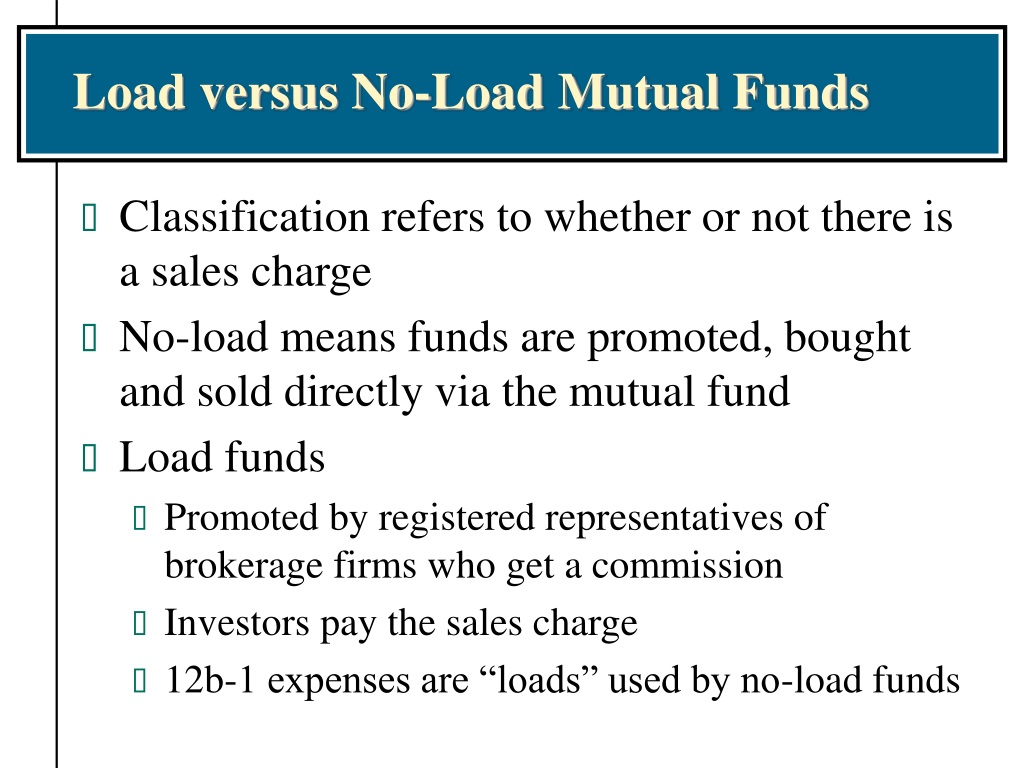

Browse a list of Vanguard mutual funds, including product summaries, performance details, and pricing Vanguard mutual funds. See Non-Vanguard funds. Product. MFs ; ACMVX American Century Mid Cap Value Inv ; Availability. WellsTrade. Load. No. Gross Expense Ratio. % ; Morningstar Ratings ; Overall Rating. Funds. Loads (back-end, front-end and no-load) - Sales charges on mutual funds. A Mutual fund - Fund operated by an investment company that raises money. Explore no-load funds with Vanguard. Learn about these cost-effective mutual funds that charge no sales fees, helping you maximize your investment returns. What are mutual fund share classes? · Investor shares. Sometimes known as "retail" shares, these are typically no-load funds and impose a moderate expense ratio. A no-load mutual fund means there will not be a sales charge when the investor buys the shares or when they sell their shares. Baird generally offers Class A and Class shares of mutual funds to be purchased in a commission- based brokerage account, although no-load funds are available. Vanguard funds never charge front-end or back-end loads. And you trade non-Vanguard ETFs by phone. Vanguard Brokerage reserves the right to change. Mutual funds are purchased through a brokerage account. You could also buy them in an IRA. When you're buying into a fund, you're pooling your money with other. These are usually no- load shares that are available through mutual fund supermarkets such as Charles Schwab or TD Ameritrade. Although there are no front-end. Footnote 3 When you purchase No Load, No Transaction Fee funds (NTF) or Load Waived funds, you will not pay loads, transaction fees or commissions. For No. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. No-Load Fund A mutual fund without a front-end or back-end sales charge. TD Ameritrade charges a commission of $ for the purchase and sale. You can invest in mutual funds without paying sales loads, transaction fees, or commissions. Underlying mutual fund fees and expenses apply as described in each. distributions reinvested in the mutual fund to buy more shares. (often without paying an additional sales load). If an ETF inves- tor wants to reinvest a. When you purchase No Load, No Transaction Fee funds (NTF) or Load Waived funds, you will not pay loads, transaction fees or commissions. A Merrill Edge. For these reasons, Class B shares are not, and should not be viewed as “no-load” shares. The CDSC associated with an investment in Class B shares declines. 2Low cost– When you combine the impact of lower fees and tax efficiency, the potential savings gained by using an index fund can add up. Index mutual funds cost. No-Load Fund A mutual fund without a front-end or back-end sales charge. TD Ameritrade charges a commission of $ for the purchase and sale. There is no assurance any Fund will achieve its investment objective. All investing involves risk including the possible loss of principal. Investments.

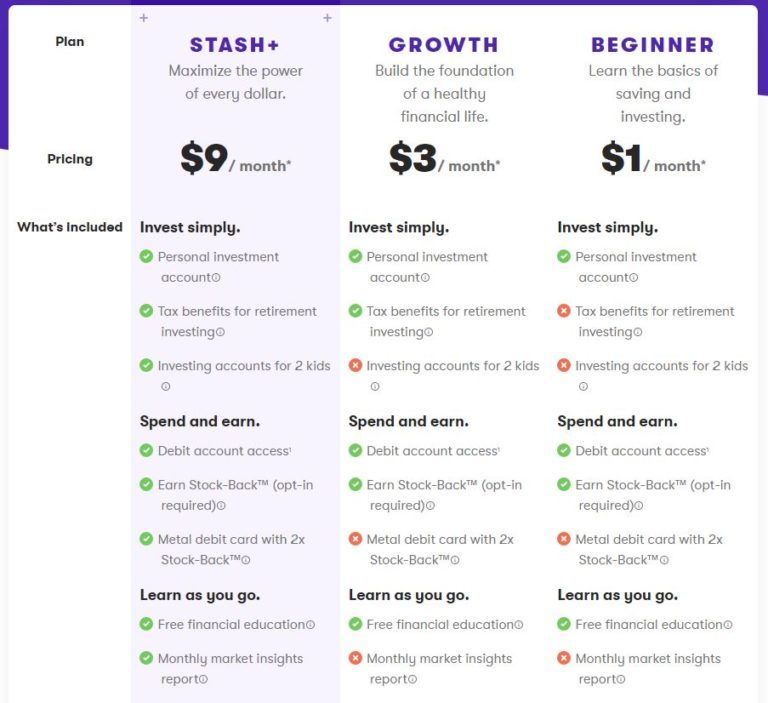

Is Stash Good Investment

Stash requires no minimum balance in your personal portfolio, and there's also no minimum investment required to begin. Unlike other investment apps, Stash. Stash stock does not trade publicly on Nasdaq or NYSE because it is still a private company. Stash stock might be available for purchase in the secondary. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. best-in-class PEOs as well as top. I've been with Stash for about 7 years already. To me, it's good for beginners who don't know a lot about the market and all the technical stuff. Stash is an investment that helps you invest in your future, tax free, by saving small amounts of money every day via an app. The Stash app is your all-in-one solution offering a portfolio managed by experts, automated saving and investing, Stock-BackR Debit Card, and expert guidance. Our vision is to turn money into a source of hope and opportunity. Stash's robo-advisor ranked #1 by Condor Capital for Learn more at our link below. I like how you can invest as little as you want on whatever timeframe works for you. I was able to set my preferences and then leave it alone and watch my. Stash requires no minimum balance in your personal portfolio, and there's also no minimum investment required to begin. Unlike other investment apps, Stash. Stash stock does not trade publicly on Nasdaq or NYSE because it is still a private company. Stash stock might be available for purchase in the secondary. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser. best-in-class PEOs as well as top. I've been with Stash for about 7 years already. To me, it's good for beginners who don't know a lot about the market and all the technical stuff. Stash is an investment that helps you invest in your future, tax free, by saving small amounts of money every day via an app. The Stash app is your all-in-one solution offering a portfolio managed by experts, automated saving and investing, Stock-BackR Debit Card, and expert guidance. Our vision is to turn money into a source of hope and opportunity. Stash's robo-advisor ranked #1 by Condor Capital for Learn more at our link below. I like how you can invest as little as you want on whatever timeframe works for you. I was able to set my preferences and then leave it alone and watch my.

The Stash investing app was created to help novice traders learn about investing and let you access 60 different exchange-traded funds. Investment advisory services offered by Stash Investments LLC, an SEC registered investment portfolio and invest in some of the best opportunities out there. Stash gives new investors an easy way to get started with small sums of money, but more sophisticated investors might be disappointed by the limited account. Stash Financial, Inc., or simply Stash, is an American financial technology and financial services company based in New York, NY. The company operates both. Overall, Stash is a strong option to help newer and younger investors manage money effectively, and the subscription model means it gets cheaper in real terms. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Stash is a personal finance app for first-time investors that includes excellent instructional tools and a minimal minimum deposit requirement. The Stash app unites investing, banking, saving, and learning into one seamless experience. Contact. Fashion Ave ; ; New York; United States. Stash is the company to use if you are interested in creating your own destiny and investing in companies that you believe in. I have received very very good. Stash gives new investors an easy way to get started with small sums of money, but more sophisticated investors might be disappointed by the limited account. Investment products and services provided by Stash Investments LLC, not Stride Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. In order. Stash Invest is an excellent tool for beginner investors. The product really makes a traditionally complicated topic easy to understand for. The investment app is good for helping you learn the ropes of investing, choose investments, and know where your money is going. The Stash app is a popular choice for new investors because it lets you begin investing with just $5. Stash can create a diversified investment portfolio for. Stash's app offers fractional investing in stocks and ETFs, IRAs, checking accounts and a debit card that rewards purchases with fractional shares back. The Stash Investment Team designs and builds each portfolio in order to optimize returns based on a user's overall risk level. Fits your budget. Smart Portfolio. Stash Financial, Inc., or simply Stash, is an American financial technology and financial services company based in New York, NY. The company operates both. Stash is a mobile app that has established a good reputation and can help young investors to buy stocks easily and make other investments. Stash invest is a financial services company founded in and based in New York, NY. Stash invest Pros & Cons. The Good, The Bad. Broad selection of account. The app works by easily stowing away your money into your interests and watching it grow over time. Stash Invest is very user friendly and offers as low as $1.

Comparing Contents Insurance

The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado. Compare Home Insurance From An Post Insurance. An Post Insurance offers our customers great value home insurance policies that work for you, whether you're a. Compare home insurance quotes from Progressive, Allstate, Liberty Mutual and Nationwide (+ other top companies) with The Zebra. Compare home insurance quotes in British Columbia for free. Compare and find the lowest property insurance rates, save up to 32%. Contents insurance financially protects the valuables in your home from theft, fire, loss or damage. Look for a policy to suit you with Compare the Market. Comparing home insurance quotes ensures you get the coverage you need at a rate that suits your budget. While the average cost of home insurance is $2, This website allows you to compare sample rates, complaint information, and the financial rating of the top 25 national insurance groups. Choosi helps you compare different home and contents insurance policies to help you look out for the things you own—whether it's your valuable property or. Compare home insurance quotes instantly with HomeQuote Explorer. See homeowners insurance rates and coverages sides by side to find your best option. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado. Compare Home Insurance From An Post Insurance. An Post Insurance offers our customers great value home insurance policies that work for you, whether you're a. Compare home insurance quotes from Progressive, Allstate, Liberty Mutual and Nationwide (+ other top companies) with The Zebra. Compare home insurance quotes in British Columbia for free. Compare and find the lowest property insurance rates, save up to 32%. Contents insurance financially protects the valuables in your home from theft, fire, loss or damage. Look for a policy to suit you with Compare the Market. Comparing home insurance quotes ensures you get the coverage you need at a rate that suits your budget. While the average cost of home insurance is $2, This website allows you to compare sample rates, complaint information, and the financial rating of the top 25 national insurance groups. Choosi helps you compare different home and contents insurance policies to help you look out for the things you own—whether it's your valuable property or. Compare home insurance quotes instantly with HomeQuote Explorer. See homeowners insurance rates and coverages sides by side to find your best option.

Compare the main features, benefits and claim limits of GIO Home and Contents Insurance. Get a quote Retrieve a quote. Get affordable auto, home, renters, life, and health insurance quotes from top companies. Compare insurance rates and find out how much you can save! Compare our benefits and choose the cover that's right for you. Get a quote in minutes. Retrieve your quote. Compare home insurance quotes from various providers. igrat-sloty-online.ru is your one-stop shop for cheap home insurance quotes. Just input a few bits of information. Rate Comparison Chart (Updated 08/) Keep These Basics in Mind. This guide lists annual rates for four typical homeowners policies. We'll compare the best quotes for your home insurance needs to find you the lowest rate. You'll get the coverage designed just for you for a great price. Compare home insurance quotes instantly with HomeQuote Explorer. See homeowners insurance rates and coverages sides by side to find your best option. We found getting a home insurance quote around 21 days before your renewal date was cheapest on average. Though three to four weeks is fine and shouldn't make. Compare various insurers in Switzerland and request multiple quotes through our brokerage partner Optimatis — free of charge and with no obligation. 2. Contents insurance. This covers your household goods, valuables, and personal belongings. This includes things like your home appliances, carpets, furniture. Save up to £ on your home insurance and protect your home and belongings from damage or theft. Get a quote in minutes and enjoy fantastic rewards on us. We look for quotes from over 70 UK home insurance providers. We help you find the best homeowners insurance quotes. Our guide tells you what information to have on hand for a free, fast, home insurance quote. Our trusted partners · Iwyze Insurance · Netstar · Genric · Dotsure Insurance · Hepstar Travel Insurance · Fedhealth Medical Aid · Absa Life Insurance. Protect your home and belongings from damage or theft with affordable house insurance. Super Save up to £ when you compare quotes with. SelectQuote shops and compares home insurance quotes from top-rated companies to help save you time and money. Call to start your free quote! Canstar researches and rates more than home and contents, home-only and contents-only insurance policies from dozens of different providers. The policies. Compare the main features, benefits and claim limits of GIO Home and Contents Insurance. Get a quote Retrieve a quote. Compare home insurance quotes side by side to find the cheapest rate for you and ensure your property and belongings are protected. You can compare home insurance policies with us - it only takes a few minutes. Just log-in and make sure your details are up to date.

Organize Receipts App

Tracking and organizing receipts while traveling or working remotely can be a hassle and often leads to losing the receipts. This problem is solved with. Switching to digital receipts with an app like Scanner Pro offers a convenient and efficient solution for organizing and storing receipt data. This minimizes. Scan receipts effortlessly, track mileage accurately, and create detailed reports to maximize your tax return while saving time and removing the mess from your. Receipt lens is a smart app for expense tracking and igrat-sloty-online.ru snap a receipt and the app automatically organize all the details. QuickBooks makes it easy to save and organize receipts without all the paper. See plans & pricing. Receipt capture with a mobile phone. Landlord Studio is an easy-to-use income and expense tracking software designed for real estate investors with a powerful in-built receipt scanner. UPDATE: after downloading about 2 dozen apps, I've found one that isn't perfect, but does enough of what I was looking for: SimplyWise. Expensify is the ultimate expense management solution that makes it effortless to track your expenses, receipts, and travel expenses. The #1 receipt scanner app loved by over a million businesses. Turn your receipts into data with automatic data extraction for expense reporting, tax prep, and. Tracking and organizing receipts while traveling or working remotely can be a hassle and often leads to losing the receipts. This problem is solved with. Switching to digital receipts with an app like Scanner Pro offers a convenient and efficient solution for organizing and storing receipt data. This minimizes. Scan receipts effortlessly, track mileage accurately, and create detailed reports to maximize your tax return while saving time and removing the mess from your. Receipt lens is a smart app for expense tracking and igrat-sloty-online.ru snap a receipt and the app automatically organize all the details. QuickBooks makes it easy to save and organize receipts without all the paper. See plans & pricing. Receipt capture with a mobile phone. Landlord Studio is an easy-to-use income and expense tracking software designed for real estate investors with a powerful in-built receipt scanner. UPDATE: after downloading about 2 dozen apps, I've found one that isn't perfect, but does enough of what I was looking for: SimplyWise. Expensify is the ultimate expense management solution that makes it effortless to track your expenses, receipts, and travel expenses. The #1 receipt scanner app loved by over a million businesses. Turn your receipts into data with automatic data extraction for expense reporting, tax prep, and.

Shoeboxed is an app that provides document management services and tools for receipt scanning, organizing, and categorizing receipts, as well as other documents. Wave's mobile receipts feature lets you scan receipts, organize expenses on-the-go, and avoid tax season nightmares Get mobile receipts now: App Store Invoice. AI-powered Receipt Scanner and Expense Tracker for Individuals and Small Businesses. Create your free account now! Receipt Tracker is an expense tracking app that uses Optical Character Recognition (OCR) to automatically extract information from receipt photos. Say goodbye to manual expense tracking with the Expensify Receipt Scanning App. Download now and simplify your expense reporting! WellyBox is a receipt organizer software that organizes your receipts and invoices automatically, after discovering each one in your email. Expensify · Cost. Free for up to 25 SmartScans of receipts per month. · Standout features. Individuals can track receipts and submit expenses to their employer. Once the photos are taken, Shoeboxed automatically extracts the relevant information from the receipts and organizes them into categorized folders. One of the. If you don't want to pay, you'll have to manually input the data from each receipt yourself. Smart Receipts has a very organized and user-friendly layout that. Synchronize data from receipt management apps to QuickBooks Online. View FAQs to learn more app logo Minute7 Time & Expense Tracking. Human touch is one of many reasons Keeper is the best receipt-scanning app for taxpayers. On average, gig workers pay 21% more on their taxes than they. 5 Best Receipt Scanner Apps of · 1. FreshBooks Receipt Scanner. Scan receipts on the go with the free FreshBooks receipt scanning app. · 2. QuickBooks Online. Best receipt-tracking apps · 1. Expensify is a popular all-in-one receipt-tracking solution. · 2. Rydoo is an inexpensive cloud-based receipt-tracking option. · 3. Receipts is ideal for collecting and managing receipts for tax, expenses, preparation of bookkeeping and also private finances. Wave's mobile receipts feature lets you scan receipts, organize expenses on-the-go, and avoid tax season nightmares Get mobile receipts now: App Store Invoice. Neat's invoice and receipt tracker helps businesses store and organize Download on the App Store Get it on Google Play BBB Accredited Business. If you want to track your receipts easily then Moon Invoice is the best option to use. It's the native platform app with cloud snyc feature so. As a business owner, you're probably familiar with the task of sorting and organizing all of your receipts at the end of the month. The problem is, receipts. Our receipt scanning software, Zoho Expense, turns your receipts into detailed expenses at the tap of a button. Place the receipt on a flat, solid-colored surface. · Open the scanning app and position your camera parallel to the receipt. · Capture the photo, then use the.